Exploring Exit Mechanisms in Commercial Property Syndications.

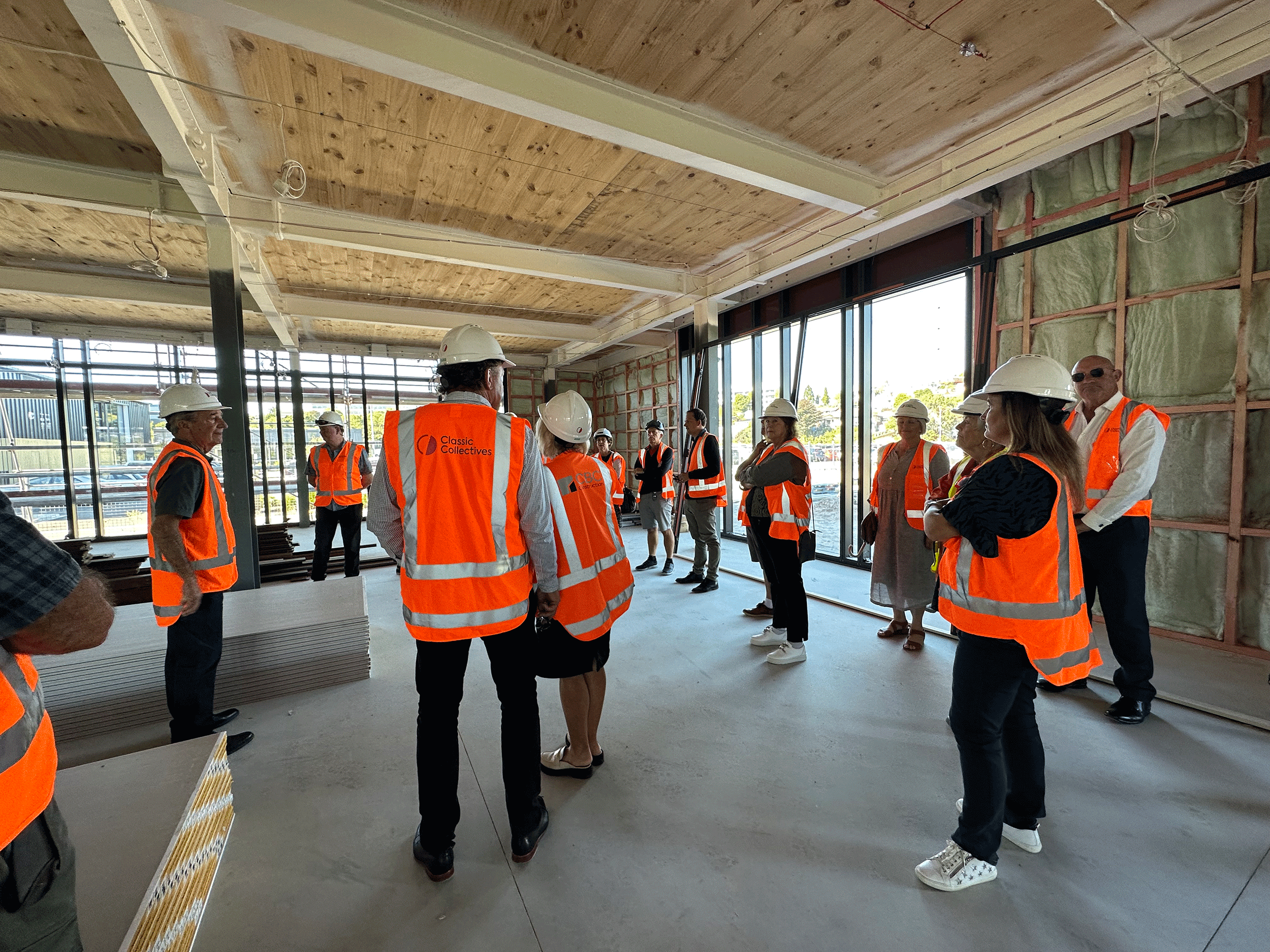

Commercial property syndications present an opportunity for wholesale investors to pool their funds and gain access to commercial assets that might otherwise be financially out of reach on an individual basis.

While the potential returns of commercial property syndications are enticing, it’s important to address the common concern that many investors have: the ease of cashing out their investments when the time comes.

Commercial property syndications may not be suitable for everyone, particularly those seeking immediate liquidity as their primary concern. However, it’s crucial to recognise that, like many investments, the greatest returns are often achieved over the long term. Building a robust and diversified portfolio that includes varying degrees of liquidity can play a pivotal role in ensuring your overall investment strategy is optimised.

With a deeper understanding of exit mechanisms, we hope to empower our wholesale investors to make sound investment choices that align with their financial goals and maximize the potential of their portfolios.

The content presented in this article is intended for general informational purposes only and should not be construed as personalised investment advice. Investing in commercial property, like any other investment, involves inherent risks. It is strongly recommended that you consult with a qualified financial advisor who can assess your individual circumstances and provide tailored advice on the most suitable investment options for you.

Understanding the Long-Term Nature of Commercial Syndication

First and foremost, it is crucial to recognise that commercial property syndications are not generally pursued as a short-term investment. Syndications of a commercial nature typically require a long-term commitment to realize the full potential of returns such as capital appreciation and ongoing rent review mechanisms. Investors should approach syndication with a mindset geared towards building wealth over an extended period.

Strategic 5-Year Reviews

That being said, it’s standard in all Classic Collectives Partnership Agreements to include a Strategic 5-Year Review. This review period offers investors a guaranteed exit after five years, which provides a sense of security and predictability – and a guaranteed exit plan. Generally speaking, commercial property syndications don’t have a fixed term – so these built-in review periods give our wholesale investors greater flexibility than typical syndications.

Secondary Market

Additionally, Classic Collectives’ investors have the option to sell their shares to other existing shareholders within the syndicate at any time, providing an additional layer of flexibility in case they need to liquidate their shares.

In summary, a deep understanding of exit mechanisms can empower wholesale investors to make informed investment choices that align with their financial goals and optimize the potential of their portfolios. By building a robust and diversified investment strategy that includes varying degrees of liquidity, investors can navigate the long-term nature of commercial syndications and position themselves for potential long-term wealth accumulation.