We bring investors together to own exceptional commercial assets.

Welcome to Classic Collectives.

Premium Property.

Proven Returns.

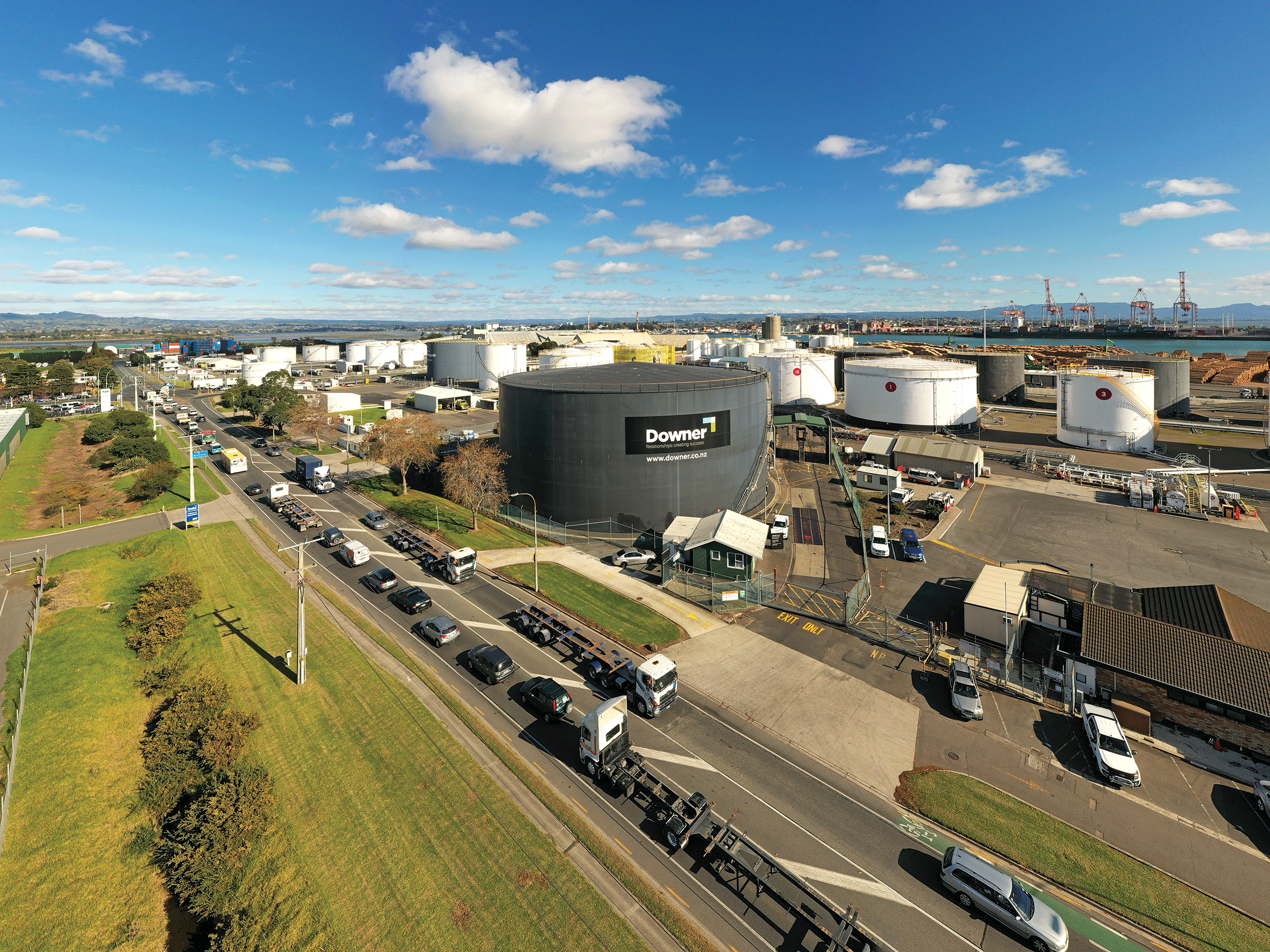

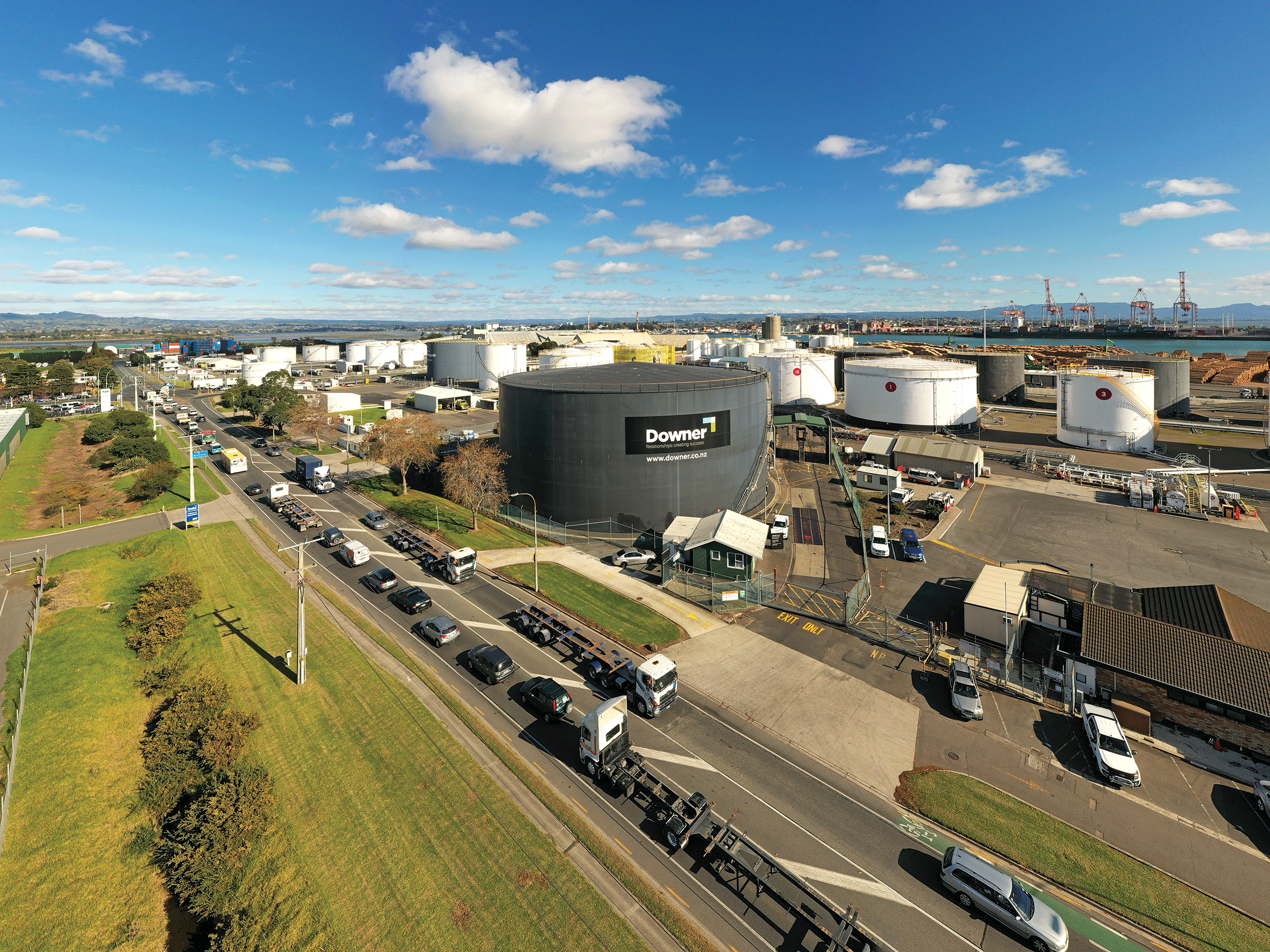

We specialise in sourcing and managing prime commercial and industrial properties for investors who value trust, quality and results.

Our syndication model brings wholesale investors together to purchase first-class assets they would otherwise be unable, or unlikely, to secure on their own. With decades of combined experience, our team handles everything – from hunting out premium opportunities across New Zealand to finding reliable national and international tenants, arranging bank financing, managing leases, financial reporting, and day-to-day administration.

Owning premium commercial property provides steady rental income, long-term growth, tax efficiencies and security from A-grade tenants. By investing with Classic Collectives, you gain access to opportunities usually reserved for institutional players while enjoying the transparency, communication and personal service of a boutique company.

If you’re seeking a smart, effective way to grow your wealth, premium commercial property investment with Classic Collectives is a reliable choice.

Welcome to Classic Collectives

Premium Property. Proven Results.

We specialise in sourcing and managing prime commercial and industrial properties for investors who value trust, quality and results.

Our syndication model brings wholesale investors together to purchase first-class assets they would otherwise be unable, or unlikely, to secure on their own. With decades of combined experience, our team handles everything – from hunting out premium opportunities across New Zealand to finding reliable national and international tenants, arranging bank financing, managing leases, financial reporting, and day-to-day administration.

Owning premium commercial property provides steady rental income, long-term growth, tax efficiencies and security from A-grade tenants. By investing with Classic Collectives, you gain access to opportunities usually reserved for institutional players while enjoying the transparency, communication and personal service of a boutique company.

If you’re seeking a smart, effective way to grow your wealth, premium commercial property investment with Classic Collectives is a reliable choice.

How Our Syndicates Work.

Our syndication model makes large-scale commercial property ownership accessible, straightforward and secure. Instead of shouldering the risk and multi-million dollar price tag of a property alone, investors pool their funds into a “Collective”.

Each Collective is carefully structured and managed by our experienced team, who handle everything from due diligence and financing through to tenant management and financial reporting. Investors simply enjoy the benefits of ownership without any day-to-day headaches.

Importantly, our model is designed with a long-term view. Properties are actively managed and periodically strategically reviewed allowing time for capital growth while smoothing out economic cycles. Exit opportunities are available , but the biggest rewards come from playing a long game.

Our funds have already secured prime assets worth hundreds of millions of dollars – from industrial distribution centres to specialist medical facilities – all with resilient tenants and long-term leases. We expect the value of these assets to rise in the years to come.

By investing as a group, individuals gain the confidence, stability and leverage that collective ownership provides. Classic Collectives makes it possible to own a stake in premium commercial and industrial property and build wealth together.

How Our Syndicates Work.

Our syndication model makes large-scale commercial property ownership accessible, straightforward and secure. Instead of shouldering the risk and multi-million dollar price tag of a property alone, investors pool their funds into a “Collective”.

Each Collective is carefully structured and managed by our experienced team, who handle everything from due diligence and financing through to tenant management and financial reporting. Investors simply enjoy the benefits of ownership without any day-to-day headaches.

Importantly, our model is designed with a long-term view. Properties are actively managed and periodically strategically reviewed allowing time for capital growth while smoothing out economic cycles. Exit opportunities are available , but the biggest rewards come from playing a long game.

Our funds have already secured prime assets worth hundreds of millions of dollars – from industrial distribution centres to specialist medical facilities – all with resilient tenants and long-term leases. We expect the value of these assets to rise in the years to come.

By investing as a group, individuals gain the confidence, stability and leverage that collective ownership provides. Classic Collectives makes it possible to own a stake in premium commercial and industrial property and build wealth together.